Trend Following Primer Series – Diversification is Never Enough….. for Trend Followers – Part 10

Primer Series Contents

- An Introduction- Part 1

- Care Less about Trend Form and More about the Bias within it- Part 2

- Divergence, Convergence and Noise – Part 3

- Revealing Non-Randomness through the Market Distribution of Returns – Part 4

- Characteristics of Complex Adaptive Markets – Part 5

- The Search for Sustainable Trading Models – Part 6

- The Need for an Enduring Edge – Part 7

- Compounding, Path Dependence and Positive Skew – Part 8

- A Risk Adjusted Approach to Maximise Geometric Returns – Part 9

- Diversification is Never Enough…for Trend Followers – Part 10

- Correlation Between Return Streams – Where all the Wiggling Matters – Part 11

- The Pain Arbitrage of Trend Following – Part 12

- Building a Diversified, Systematic, Trend Following Model – Part 13

- A Systematic Workflow Process Applied to Data Mining – Part 14

- Put Your Helmets On, It’s Time to Go Mining – Part 15

- The Robustness Phase – T’is But a Scratch – Part 16

- There is no Permanence, Only Change – Part 17

- Compiling a Sub Portfolio: A First Glimpse of our Creation – Part 18

- The Court Verdict: A Lesson In Hubris – Part 19

- Conclusion: All Things Come to an End, Even Trends – Part 20

Diversification is Never Enough…For Trend Followers

When dealing with diversification, it is tempting to adopt conventional wisdom and talk in terms of diversification as a method to reduce overall portfolio risk exposure, but for trend followers, diversification is so much more. It provides a method to probe the markets and capture the elusive outlier, it allows a trend follower to take advantage of correlated markets that are beneficial to their cause and it allows a trend follower to capture the many forms of trend form that exist in the land of the fat tailed environment.

For that reason, the title of this Primer suggests that there can never be enough diversification for trend followers. In this Chapter we explore the conventional aspects of diversification and then also explain the many additional benefits that diversification can bring for the diversified systematic trend follower.

Principles of diversification relate to how we can obtain additional benefits from a portfolio above and beyond what can be achieved by its component return streams. In effect this statement is saying that ‘the whole is greater than the sum of its parts’. It provides an essential overlay for all systematic trend followers that we simply cannot go without.

Some trend followers think that diversification holds the mystery to the ‘secret sauce’ of trend following and why the method is so robust as a trading technique. I am happy to leave people with that conclusion. For diversification is not just a ‘free lunch’ it is a ‘free banquet’ for the entire Trend Following community.

The power of diversification for trend followers is one of the most important aspects of our approach to trading these markets and so we will be spending a little more time digging into the nuances of diversification in this Primer.

Some of the Many Benefits of Diversification for Trend Followers

In our prior Primer, we saw how diversification is a tool used by trend followers to sculpt an optimal path of returns for the purposes of compounding. This is the primary reason for why trend followers dedicate their efforts towards diversification. After all, delivering absolute returns and significant windfalls in net wealth over the long term is what this game is all about.

Risk management through diversification however is simply one aspect of the optimal path for compounding that reduces the adverse volatility of the portfolio equity curve, but we should never forget the other important aspect of the optimal path which is ‘beneficial volatility’ and its impact on compounded growth.

In terms of this beneficial aspect of volatility for trend following portfolios, diversification is our preferred method of increasing our chances of catching outlier moves and capturing any beneficial correlations that exist across return streams when markets get ugly and highly correlated. This feature of diversification exponentially magnifies geometric returns.

But there are many more benefits as well.

The list below includes some of the many powerful benefits of diversification that are specific to trend followers who target the tails of the distribution of market returns. Some are applicable to other alternative trading and investment methods, but many are specific for our trading approach. You can therefore understand why a trend follower can never be diversified enough and that our efforts are placed on continuously improving our systematic diversified portfolios:

- Diversification is a method to balance the adverse volatility present in a portfolio equity curve using correlation offsets, to produce higher risk adjusted returns than could otherwise be achieved through its constituent parts;

- Diversification is a method to take advantage of beneficial volatility in a portfolio equity curve either by increasing our chances of riding outliers, or by summating positively correlated ‘beneficial aspects’ of return streams to accelerate the compounding effect;

- Diversification is a method to increase trade frequency for a trend follower who need to patiently wait to enter ‘material trends’. More opportunities are provided under diversification to capture outliers; and

- Diversification is a method to capture many different forms of trend and trend segments known to occur outside the Gaussian envelope that are inherently unpredictable in form, and is a method that allows a Trend Follower to offer a distinct point of difference.

Diversification – A Method to Balance Risk in a Portfolio

At the broadest level from which most traders would be familiar, diversification seeks to reduce a trader’s exposure to the risk of any single return stream by spreading their trading capital across numerous return streams that are uncorrelated in nature. The basic premise is that when one return stream is under-performing and entering a drawdown, the other return streams in the portfolio are hopefully performing, and thereby offsetting the impact of this single drawdown in the portfolio.

The principles of diversification therefore seek to smooth adverse volatility of the portfolio equity curve. I refer to this diversification process as ‘weaving the most robust tapestry’. So, chart 25 below shows the loom which contains 25 various threads (return streams), and Chart 26 shows the robust tapestry produced after we weave the threads together.

Chart 25: Twenty-Five Return Streams Compiled into a Portfolio – “The Loom”

Chart 26: Twenty-Five Return Streams Compiled into a Portfolio – “The Tapestry”

Let us have a detailed look at how this principle works where we start with Chart 27 to observe this principle in action.

Chart 27: Adverse Risk of Return Streams which are Offset in a Diversified Portfolio – Single Return Stream

Chart 27 reflects a single non-compounded return stream of GBPUSD which has a volatile signature. In this example we apply a $50,000 initial balance towards a single return stream ending in a final balance of $65,810 over the 21-year period.

Notice that the Reward to Risk relationship between the Return on Investment (ROI) and the Maximum Drawdown is a MAR ratio of 0.15. This provides an expression of the risk adjusted performance of this return series and its capacity to benefit from compounding through increased leverage over the time series.

Notice also how the Maximum drawdown was reached in July 2014. This clearly was an unfavourable environment for trending conditions in GBPUSD over this period. In fact, the unfavourable period extended for a 4-year period commencing in late 2009.

This maximum drawdown and its extent is a signature that we take note of. It is a sign of possible risk weakness for an overall portfolio if that return stream was included in a compilation of return streams. In this case, the Maximum Drawdown for GBPUSD was quite extreme relative to the overall path of the return stream it generated. This has led to a low MAR ratio which states that this return stream is unlikely to positively contribute to a portfolio and has risk weakness embedded within it.

So now that we understand what MAR tells us about a return stream, let us see what is produced when we compound this return stream in Chart 28.

Chart 28: Monthly Compounded Portfolio – 1 Return Stream

Chart 28 reflects that given the poor risk adjusted metrics of the single return stream, it was hardly worth the effort compounding this solution. The initial $50,000 balance ends up with only a very slight increase to $67,643. Now a Compound Annual Growth Rate (CAGR) of 1.43%

But what happens if we diversify the portfolio across 4 different return streams?

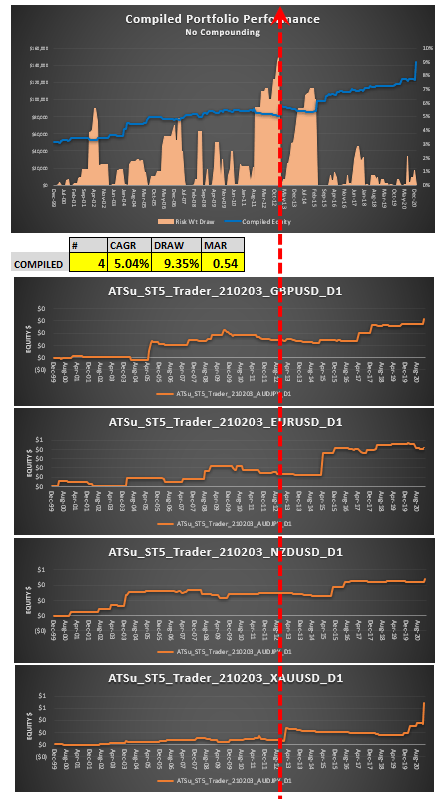

Have a close look now at how diversification works in Chart 29 where our initial $50,000 portfolio now includes 4 separate return streams under a non-compounded case which includes our GBPUSD example.

Chart 29: Adverse Risk of Return Streams which are Offset in a Diversified Portfolio – Multiple Return Streams

Note: In this example, the return streams represent diversification across markets, but the principle is the same for return streams generated by diversification across timeframes and diversification across systems.

Now the first thing to notice in Chart 29 is that the final balance at the end of 21 years staring with an initial balance of $50,000 is now $144,358. Wow! We haven’t cherry picked these examples, but simply find that by diversifying across different return streams, some of those return streams have simply offered outstanding long term performance metrics. Thank goodness for our non-predictive logic.

When we were back in 2000 and allocating initially to GBPUSD, we had no expectation regarding future performance. However, back at 2000, if we now equally allocated across 4 different return then, without any form of selection bias, we have found that we significantly improve the non-compounded result. This is the same principle that venture capitalists use in their selection process that seeks to find a handful of possible winners from a large basket of future ‘false starts’.

So back to our risk management story under diversification for Chart 29. We have equally allocated risk across 4 return streams (not simply one return stream) using our trend following models, with no assumption made about whether they are extremely correlated or not. We just assumed that they would not be 100% correlated with each other across the entire length of the return stream.

So, recognising that the different return streams are unlikely to be perfectly correlated, we should receive adverse risk correlation offsets that will assist our endeavors.

When we examine Chart 29, notice how now the adverse maximum drawdown of the portfolio now resides at August 2012 and not the prior maximum drawdown observed for GBPUSD of July 2014. Under diversification, the principle of re-balancing risk across the portfolio has now been observed. The maximum drawdowns of individual return streams have now been offset.

The new maximum drawdown for the compiled portfolio is now 9.35%, which in this example is slightly higher than GBPUSD alone of 8.62% but in terms of its impact on geometric returns over the long-term, it must be expressed in relation to the return that the portfolio now delivers. So given this understanding, let us look at the ROI to see if any benefit has been received by the portfolio to compensate this slight increase in drawdown exposure.

Just look at what the ROI now is! For a small increase in Maximum Drawdown, we now achieve an uncompounded ROI of 5.04%. This is a massive increase in ROI from our GBPUSD series of 1.30%. In fact, we can see the improvement in the risk adjusted metric of MAR in that it has increased to 0.54 from 0.15 which is a 3.5x increase over the time series.

This means that this compiled portfolio will perform significantly better under monthly compounding.

So let us see what it produces when compounded.

Chart 30: Monthly Compounded Portfolio – 4 Return Streams

Kaboom, kapow!! Chart 30 reveals that under monthly compounding the initial $50,000 balance has now increased to $271,181. This is a $126,824 increase from the non-compounded final balance result of $144,358. A CAGR of 8.04%.

Last words on Risk

While it is tempting to conclude with these examples that diversification is a method to reduce overall portfolio risk exposure, it does no such thing. Risk cannot be created or destroyed once a trade has been initiated in the marketplace. Only transferred. This is a strict Conservation Law for the Financial Markets. We can never eliminate risk, as risk is encountered as soon as we elect to undertake a trade event and participate in the markets, but we can manage it within ‘reasonable bounds’.

A portfolio is therefore a method we use to not reduce but rather ‘balance’ the risks associated with its constituent return streams by using principles of offset.

So, while a portfolio balances the risks in a portfolio, the total summated risk of all constituent return streams is still all there. We like to refer to a portfolio as a risk sponge that soaks up all risks and stores it in its architecture but relies on the fact that the constituent return streams can offset adverse risk by their uncorrelated nature.

The only way we can release risk from the portfolio is by removing a return stream from it. This is achieved by taking a trade exit and is not a feature of the portfolio itself but a feature of the trend following system that creates that return stream.

So, if you have a portfolio compiled of trend following systems where each system includes a stop and trailing stop condition, then by trade exit, the risk associated with a single return stream in a portfolio is released. We liken this to a release valve of a pressure cooker whereby risk (aka steam) is periodically released from the portfolio to lower the summated risk that resides within.

However, if you do not have risk release valves in your systems that make up your portfolio, then risk remains, and in a non-stationery market where correlations can alter and dilute the risk offsets, adverse risk can build to a point where ultimately, without risk release, we can have portfolio collapse.

Diversification – A Method to Take Advantage of Beneficial Volatility

Now we have already discussed this principle at length in our prior Primer so we can keep this brief.

Just as we use diversification to provide correlation offsets that reduce overall adverse volatility across the return streams of a portfolio, we also use diversification to hunt for outliers and deliver correlation benefits that magnify geometric returns.

Now the reason for highlighting this little nugget and why it is only applicable to trend following is based on the design principle of our trend following solutions. You all know that we ‘cut losses short and let profits run’…but the deeper significance to this statement is it creates an asymmetrical reward to risk profile that allows us to capitalise on outliers without exposing ourselves greatly to adverse risk.

Under diversification, using our asymmetric systems, we can then hunt for outliers and also benefit from any positive correlation that may exist across return streams without exposing us to left tailed events. We can only do this when possessing asymmetric solutions that leave ourselves open to positive outliers while we cut our losses quickly in times where left tailed events can create adverse risk events.

Many traders shudder when we select return streams that clearly are correlated, but the reason for our confidence is that our system designs are going to save us from the tail risk present in trading a correlated series.

So, in addition to the benefits received by diversification in hunting for outliers over single return streams, we now have a further benefit not afforded to alternative trading mechanisms where we can be bold and trade quite highly correlated return streams. This is the reason for why trend following Fund Managers perform well during ‘crisis alpha’ periods where all markets start exhibiting correlated behaviour across asset classes. Trend followers can confidently trade within this highly correlated context, by virtue of the risk mitigation mechanisms they deploy within each return stream that exists in their portfolio.

Trends can arise from influences inside or outside the financial system. For example, when arising from inside the financial system, being diversified allows trend followers to capitalise on opportunities close to the source of the instability and then also benefit from the domino effect of that impact as it is spreads across the financial sector into other asset classes. This creates a favorable sequence of trending events that are easy to trade using diversified trend following systems.

Trends may also arise from outside the financial system such as the corona virus for example. In these instances all asset classes can feel this immediate impact, but having a diversified suite of short term systems allows many diversified trend followers to capitalise on this immediate impact. Trend followers with long term systems, can feel the brunt of such an aggressive impact across the sector, however their risk mitigation mechanisms allow them to reduce their overall exposure when compared to many alternative trading methods.

Remember that Trend Followers do not ‘warehouse risk’ in our return streams. We use risk mitigation mechanisms to ‘release risk’. As a result, we find that at the portfolio level we usually are optimally configured to take on additional future risk with our portfolios. So, when markets get nasty, and convergent methods are being ‘squeezed’, the trend followers can confidently take the other side of the trades without exposing themselves in the same way to tail risk and in doing so make ‘crisis alpha’.

Outliers for any single return stream can lie in isolation or they can cluster during periods of ‘crisis alpha’ when the inter-related nature of markets all start to sing in tune. We can harness this power of angry markets to accelerate our geometric returns.

Diversification- A Method to Increase Trade Frequency when Targeting Tail Events

One of the issues surrounding trend following, when trading fat tailed environments is that the trade sample size for each return stream is usually very low. We are very selective in when we decide to participate in a trending condition and when we latch onto an outlier, we could be riding it for many years. As a result, each return stream may only comprise a handful of trades.

To overcome this issue, and allow us to possibly participate in many more outliers of materiality, diversification across return streams allows us to achieve this outcome, provided that we are prepared to apply very small $risk bets to each solution.

Given our ability to trade small position sizes in these modern markets, and particularly when trading leveraged instruments where we only expose a fraction of our capital to gain exposure to these derivatives, then we can achieve extremely wide diversification under a diversified portfolio.

This therefore allows us to participate in many more tail risk events than you might think.

Applying Equal Sized Bets Across a Portfolio

Now given that we are targeting outliers that are non-linear in nature, and have the ability to dwarf the majority of returns in a trend following portfolio by their sheer magnitude, we tend to be more ambivalent in which markets we select as suitable candidates for trend following portfolios.

We simply require the following pre-requisites:

- That we only trade liquid markets;

- That we keep our bets small; and

- That we prefer a balance of market representation across asset classes of ‘different character’.

The first prerequisite is more a statement regarding risk management. With illiquid markets, we could find that a single return stream may be exposed if our risk mitigation mechanisms applied at the return stream level are not obeyed during chaotic market conditions. Sometimes, despite our best laid plans, markets can be sufficiently illiquid to fail to observe our stops and trailing stops from major gaps.

The second pre-requisite assists our first prerequisite ambition of risk mitigation, as a small bet means that even if our risk measures are not observed, it is unlikely to result in a material loss at the portfolio level. So for example during the Swiss Dollar de-peg in early 2015 where the Swiss currency pairs became highly illiquid resulting in sudden material moves, if we were incorrectly positioned for that move, then the adverse impact on the portfolio would have been large for a small bet, but not sufficient to cause total portfolio collapse.

The final pre-requisite is simply a recognition that even though we can go very far in diversification across liquid markets, there will always be capital limitations that finally put a cap on the degree to which we can diversify. Having an equal representation of return streams across asset classes is simply a statement that, when faced with having to make a choice, we elect to not expose our portfolios to possible adverse risk events that may arise in a particular asset class.

Given our general ambivalence towards whether or not a liquid market is suitable for trend following, we apply equal risk bets in dollar terms for each return stream in our portfolio. We do not apply any predictive methodology that assigns a greater weighting to a particular class of return streams.

We feel that undertaking this process might make sense for a predictive mindset that sees some markets as being better trending markets than others…however as you will know by now…that kind of predictive talk for a trend follower are fighting words.

Non-linear fat tails can happen “anywhere and anywhence”. We are not seeking ‘normal trends’ that may arise more frequently in certain markets than others given each markets characteristic volatility. We are seeking material events of non-linearity that are known to occur in any liquid market when ‘sudden’ un-predictable events of transition just happen from time to time.

As we apply equal $ risk bets to each of our return streams, we therefore need to normalise our dollar risk that we apply to each return stream to reflect their normal volatility. We do this by using Average True Range (ATR) methods that ensure that when the bets are laid, an equal $risk is applied for each bet that we lay on the table, and then we just watch and wait to see what happens.

The magnitude of an outlier can be significant, and can dwarf the average true range of volatility seen in the normal conditions of the market. The materiality of the event therefore means that we can get really small in our bet size for each return stream and still benefit from these windfalls when or where they occur due to their scale magnitude.

While we place thousands of very small bets through our method, as observed with our trade sample size for a diversified portfolio, you can see how the outlier trades that make the windfall are almost ‘scale independent’ to the rest of the trades undertaken. Wins of 25xR or even 60xR deliver king hits to the portfolio in terms of ‘step ups’ in the equity curve and we want as many of those ‘king hits’ as we can get our hands on.

Now going ‘hand in hand’ with this ability to achieve extreme diversification using many small bets applied to hundreds, or even thousands of return streams, we can only achieve this under systematic application.

Systematic versus Discretionary

Aside from our inability to back-test discretionary systems, one of the major issues surrounding discretionary trend following is our inability to achieve wide diversification under this principle.

There is no limit to the extent of diversification that we should strive for under a trend following philosophy given the added benefits that diversification brings to wealth building for trend following. Consequently, having thousands of separate return streams in a diversified portfolio is what we personally should be striving for if we really want to trade the tails.

But there is no way this ambition can be achieved under discretion. So this insists that if we want to take diversified trend following seriously, then we must be systematic in our processes.

Diversification – A Method to Capture Many Different Forms of Trend and Trend Segments and a Method to Offer a Unique Point of Difference

We have already discussed the many forms a trend can take outside the Gaussian envelope in our second Primer of this series, so there is no point laboring on about this principle here.

However we just simply need to realise that system diversification allows us to capitalise on the many forms of possible trending conditions that can exist in outliers of material significance. Having system diversification allows us to capture as much of the outlier that is possible in these exotic environments.

One of the beneficial aspects that we have not discussed however is that diversification also allows Trend Followers to have a point of difference between each other. If we were all doing the same thing, then the space would become quickly crowded. While Trend Followers are typically uncorrelated with other investment methods (such as Buy and Hold in Equities), there is considerable return dispersion with the grouping given the very broad diversification amongst our sector. This is a good thing for the long term sustainability of the Trend Following Fund Management industry.

Finale on Diversification

So here we are. Hopefully I have convinced you that under a trend following philosophy there really is no limit to the benefits that diversification can bring to wealth building. There is no such ‘marginal benefit’ limit in our view from diversification as we target the fat tails of the distribution of market returns and not the predictable peak of the market distribution. This makes our approach different to ‘predictive methods’. Diversification gives us added benefits in this ‘uncertain region’ and is an essential aspect to include in your workflow processes used to create your diversified systematic trend following portfolios.

Now you will hear in the literature about how Fund Managers use the correlation statistic as a basis to compile un-correlated portfolios, but in our next Primer I will discuss how many of us trend following folk feel that the correlation statistic is a very blunt tool that fails to address all the considerations we need to face in delivering diversification benefits to a portfolio.

We will look at the issues surrounding this blunt tool and provide alternative methods to achieve improved outcomes.

So stay tuned to this series.

Trade well and prosper

The ATS mob

19 Comments. Leave new

[…] Diversification is Never Enough…for Trend Followers – Part 10 […]

[…] Diversification is Never Enough…for Trend Followers – Part 10 […]

[…] Diversification is Never Enough…for Trend Followers – Part 10 […]

[…] Diversification is Never Enough…for Trend Followers – Part 10 […]

[…] Diversification is Never Enough…for Trend Followers – Part 10 […]

[…] Diversification is Never Enough…for Trend Followers – Part 10 […]

[…] Diversification is Never Enough…for Trend Followers – Part 10 […]

[…] Diversification is Never Enough…for Trend Followers – Part 10 […]

[…] Diversification is Never Enough…for Trend Followers – Part 10 […]

[…] Diversification is Never Enough…for Trend Followers – Part 10 […]

[…] Diversification is Never Enough…for Trend Followers – Part 10 […]

[…] Diversification is Never Enough…for Trend Followers – Part 10 […]

[…] Diversification is Never Enough…for Trend Followers – Part 10 […]

[…] Diversification is Never Enough…for Trend Followers – Part 10 […]

[…] Diversification is Never Enough…for Trend Followers – Part 10 […]

[…] Diversification is Never Enough…for Trend Followers – Part 10 […]

[…] Diversification is Never Enough…for Trend Followers – Part 10 […]

[…] Diversification is Never Enough…for Trend Followers – Part 10 […]

[…] Diversification is Never Enough…for Trend Followers – Part 10 […]